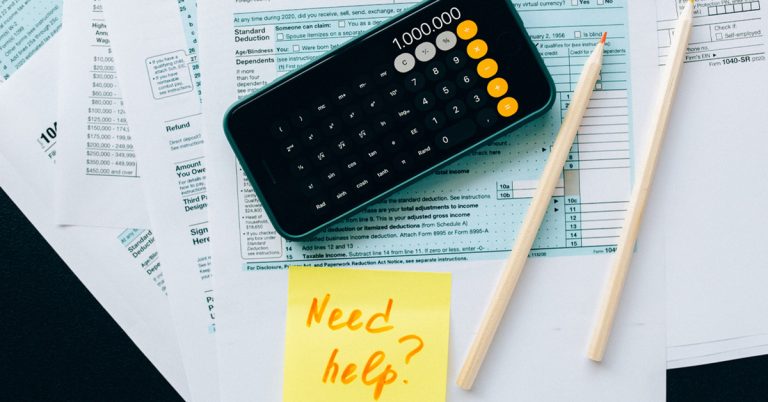

To track business expenses might seem like a hassle but ignoring it can cost you real money. Every untracked expense is a missed opportunity for tax deductions, making cash flow harder to manage and creating chaos during tax season.

Think about it: if you’re not keeping tabs on your business spending, you’re likely losing out on deductions for meals, travel, supplies, and more. Worse, come tax time, scrambling for receipts and records will lead to mistakes—and possibly an audit.

So if you are concerned and continuously thinking “how do i keep track of my business expenses”. This guide will show you how to track business expenses step by step, making sure you don’t leave money on the table and keep your business finances organized and stress-free.

Table of Contents

Track Business Expenses- Benefits & Importance

Before we dive into the *how*, let’s talk about the *why*. Keeping track of your business expenses is about more than just managing your receipts—it’s about taking control of your financial future. Here’s why tracking is so important:

- Save on Taxes: Every missed expense is a missed tax deduction. Proper tracking ensures that you claim all business-related costs, from travel to meals to office supplies.

- Avoid Cash Flow Surprises: Without tracking, you risk spending more than you realize, which can lead to cash shortages. Expense tracking helps monitor spending and prevent unpleasant surprises.

- Be Audit-Ready: In case of an audit, well-documented expenses make the process smoother and less stressful. Proper tracking means you won’t have to scramble for receipts or recall forgotten transactions.

- Informed Financial Decisions: Accurate tracking helps you see where your money is going, allowing you to make better decisions about cutting costs or investing more in areas that drive growth.

Understanding these benefits shows why expense tracking is more than just an administrative task—it’s a key to running a financially healthy business.

A Step-by-step Guide

Step 1: Separate Your Personal and Business Finances

Every single purchase, no matter how small, counts as a business expense if it’s for business purposes. Whether you’re buying office supplies, software, or taking a client out for coffee, keep the receipt.

Here are a few tips for managing receipts:

– Take photos of paper receipts as soon as you get them and store them in a cloud-based folder.

– Save digital receipts in a dedicated email folder, organized by categories like “Meals,” “Supplies,” or “Subscriptions.”

– Make a note of the reason for the expense (e.g., “Client Meeting” or “Office Supplies”), so you won’t have to guess later.

Having a system in place for receipt storage will make tracking easier, especially when it’s time to file taxes or prepare reports.

Step 2: Keep Every Receipt

You don’t need to be a data expert to use real estate analytics—it can fit right into your daily routine. Here are some simple ways to get started:

Every single purchase, no matter how small, counts as a business expense if it’s for business purposes. Whether you’re buying office supplies, software, or taking a client out for coffee, keep the receipt.

Here are a few tips for managing receipts:

– Take photos of paper receipts as soon as you get them and store them in a cloud-based folder.

– Save digital receipts in a dedicated email folder, organized by categories like “Meals,” “Supplies,” or “Subscriptions.”

– Make a note of the reason for the expense (e.g., “Client Meeting” or “Office Supplies”), so you won’t have to guess later.

Having a system in place for receipt storage will make tracking easier, especially when it’s time to file taxes or prepare reports.

Step 3: Categorize Your Expenses

Not all expenses are the same, so it’s important to categorize them properly . Categorization helps you understand where your money is going, makes tax deductions simpler, and gives you insights into which areas of your business might need adjustments.

Here are common expense categories to consider:

– Office Supplies: Everything from pens to computers.

– Meals and Entertainment: Client lunches or networking dinners.

– Travel: Flights, hotels, mileage, and other transportation costs.

– Marketing: Advertising, promotions, and digital campaigns.

– Employee Expenses: Salaries, bonuses, and reimbursements for work-related purchases.

Organize your expenses into clear categories, you’ll have a better understanding of your spending and be prepared when tax season comes around.

Step 4: Record Your Expenses Regularly

Leaving all your expense tracking for the end of the year (or even the end of the month) is a recipe for disaster. The longer you wait, the more likely you are to forget what a receipt was for or lose important documentation.

Make it a habit to record your expenses regularly . Ideally, you should log them daily or at least weekly. Here’s how:

– Set aside time each week to input expenses into your system, whether it’s a spreadsheet or a digital tool.

– Record the date, amount, category, and purpose of each expense as soon as possible.

– Regularly review your records to ensure accuracy and spot any errors early.

This consistent habit will help you avoid stress and errors down the road, particularly during tax season.

Step 5: Track Mileage for Business Travel

If you drive for work—whether for client meetings, picking up supplies, or traveling to conferences— tracking your mileage is essential. The IRS allows you to deduct business-related mileage, but only if you’ve kept detailed records.

For each business trip, log:

– The date of travel.

– The starting and ending locations.

– The purpose of the trip (e.g., “Meeting with Client X”).

– The total miles driven.

Many business owners overlook this deduction, but tracking mileage accurately can add up to significant savings at tax time. Use a mileage log, app, or even a simple spreadsheet to stay organized.

Step 6: Reconcile Your Accounts Monthly

Reconciling your bank and credit card statements with your expense records is a critical step to ensure everything adds up. Reconcile your accounts at least once a month to catch any discrepancies, missed expenses, or errors.

Here’s how:

- Compare each transaction on your statement with your expense log.

- Ensure all transactions are categorized correctly.

- Investigate any discrepancies, such as duplicate charges or missing expenses, and fix them immediately.

Doing this regularly helps you maintain accurate financial records and prevents costly mistakes down the road.

Step 7: Create an Expense Policy

Policies ensures employees understand what qualifies as a business expense, how to report it, and how approvals work.

Your expense policy should cover:

– What qualifies as a business expense (e.g., meals, travel, supplies).

– How employees should submit receipts and reports.

– Approval processes for larger or out-of-the-ordinary expenses.

With a clear policy in place, you’ll reduce confusion, ensure compliance, and make expense tracking easier for everyone.

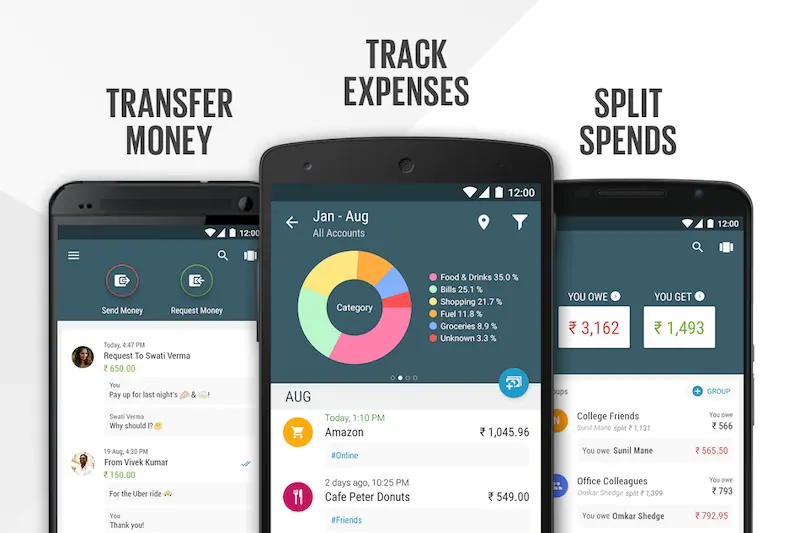

Step 8: Use an Expense Tracking Solution

Manually tracking expenses can become time-consuming and prone to mistakes, especially as your business grows. That’s why many businesses opt for an expense tracking solution to automate and simplify the process.

Here’s why using an expense tracking tool can help:

– Automated tracking: Tools automatically categorize your expenses and store digital receipts, reducing manual effort.

– Real-time reporting: Get insights into your spending patterns and stay on budget with up-to-date reports.

– Timesaving: Expense tracking solutions take care of the tedious tasks, freeing you to focus on running your business.

– Integration with accounting software: Many solutions integrate directly with popular accounting tools, making tax filing and bookkeeping even easier.

Use an AI powered an expense tracking solution, you can eliminate a lot of the manual work involved in managing expenses, save time, and minimize errors.

Budget and Adjust Take Control of Your Business Expense

Staying on top of your finances, categorizing your expenses, and using an expense tracking solution, you’ll save time, reduce stress, and maximize your deductions come tax season.

It’s all about consistency. The sooner you start following these steps and building good habits, the easier it will be to keep your financials in check. If managing receipts and expenses is starting to take up too much of your time, consider automating the process with an expense tracking solution. It’s a small investment that can lead to big savings in the long run.

Ready to take control of your business expenses? Start today!