The Situation

The finance team of a luxury retail group of companies would spend more than 25 days to generate important financial reports that were critical for taking important business decisions. Most of the data to create the financial reports, was collected from Microsoft Dynamics AX 2012 ERP directly.

Generating reports after pulling the data from the ERP was quite a tedious task, thus delaying reporting and further delaying important decision-making.

The same situation applied to marketing and sales departments as well.

The Problem

Taking key business decisions was much slower in the company as a result of redundant investment of time in generating important Business Intelligence reports. The data came from disparate data sources, considering the group of companies had eight independent finance teams.

The retail giant’s IT team could facilitate pulling information from most of this data sources by using default MS Dynamics AX Operational Reports , the IT team couldn’t identify & automate the exact methodology to pull data from MS Dynamics AX ERP.

Additionally, there were a lot of eliminations in financial consolidation, considering multiple transactions between the different subsidiaries of the luxury retail group of companies, making ad-hoc analysis a further problem.

[sf_button colour=”lightgrey” type=”bordered” size=”standard” link=”https://datasemantics.co/contact-us/” target=”_blank” icon=”” dropshadow=”no” rounded=”no” extraclass=””]Talk to us directly to know more details about the case study[/sf_button]

The Objective

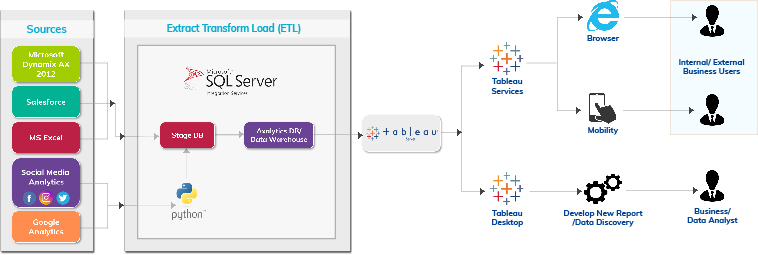

To optimize the BI reporting process and cut down wastage of time in order to enable swift decision-making for key business functions. To enable this, the company required to create a single source of truth from disparate and isolated data sources. Extract, Transform and Load (ETL) the data from various sources for data modelling to generate BI reports.

The Solution

Data Semantics identified that generating BI reports for this retail giant required automating the data extraction & Transformation process.

The team of developers used MS Integration Services to extract & automate the data from Microsoft Dynamic AX12. Team also used Python to pull data automatically from sources like CRMs (Salesforce), Google Analytics, Social Media and MS Excel. This was quite a breezy affair.

The main challenge was to pull the data from Microsoft Dynamics AX ERP as the IT team of the retail giant couldn’t identify the exact Framework & tables to pull the data.

Pulling data from such an elaborate ERP system can be daunting task as it requires specialized expertise. MS Dynamics AX shows limited indications in the database to identify the exact data tables , making it difficult to automate data extraction.

Data Semantics CTO, Imaduddin Shah, having massive experience in Microsoft Dynamics and Azure ecosystem, could identify the exact tables from the MS Dynamics AX database to pull the data from. This critical knowledge led to saving tons of time and expediting the building of data-pulling automation algorithms.

[sf_button colour=”accent” type=”standard” size=”large” link=”https://datasemantics.co/contact-us” target=”_self” icon=”” dropshadow=”no” rounded=”no” extraclass=””]Contact Us to Know More[/sf_button]

The team had to write a complex algorithm to automate eliminations in financial consolidations, especially considering the multi-currency transaction complexities from subsidiaries operating across the globe.

After building the automation systems, the Data Semantics experts made it possible to deliver the data for creating BI reports on Tableau.

Our BI experts designed beautiful dashboards on Tableau, indicating important business metrics to be easily readable for business managers across Finance, Marketing and Sales departments of the luxury retail group of companies.

The Outcome

The automation algorithms to pull the data on Microsoft SQL Server from disparate sources and aggregate it in the Data Warehouse expedited the reporting process, including financial consolidation.

The luxury retail group of companies now saves 25 critical days in their reporting process, leading to faster decision-making.

[sf_button colour=”accent” type=”standard” size=”large” link=”https://datasemantics.co/contact-us” target=”_self” icon=”” dropshadow=”no” rounded=”no” extraclass=””]Contact Us to Know More[/sf_button]